The story of the diversion of imports away from the US West Coast is well understood. While the International Longshore and Warehouse Union’s contract expired almost a year ago, the ILWU Canada contract remained in effect, only just expiring at the end of March. Consequently, one might have expected that Western Canadian ports should have benefited in the interim from cargo bound for the US Midwest seeking to avoid potential USWC labor disruption. But that has not been the case. The Western Canada growth story appears to have hit a speed bump during the pandemic surge from which it has yet to recover.

In 2019, the ports of Prince Rupert and Vancouver collectively handled roughly 2.4 million loaded import TEUs. That represented 9.1% of all loaded import TEUs arriving in the US and Western Canada that year. In 2022, the volume handled by Vancouver and Prince Rupert was actually slightly lower than 2019 – a decline of 0.3%. In contrast, the combined volume arriving in the US and Western Canada was up 16.6% over the same period. Consequently, Western Canadian share declined from 9.1% to 7.8%. The trend continued in the first quarter of 2023, with Western Canadian import TEU share down another 0.3% to 7.5%.

It is the volume bound for inland points that is the most susceptible to diversion. Intact ISO containers bound for the American Midwest have their choice of routings. How has the option to use the Western Canada gateways fared? The data says not all that well.

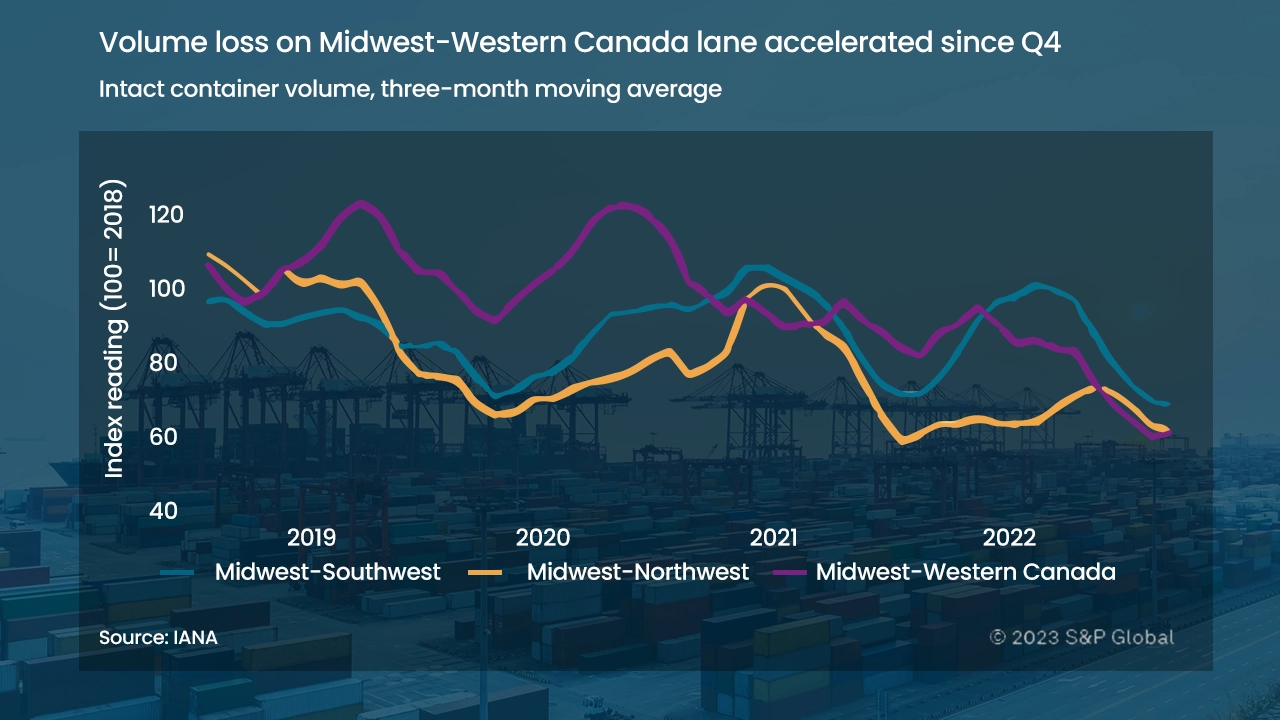

If we use the IANA ETSO data to compare the intermodal revenue moves of ISO containers taking place between the Midwest and Western Canada, volume was down 36% in Q1 as compared to the same quarter in 2019, before the pandemic. The comparable figure for arch-rival Midwest–Northwest (i.e. Seattle/Tacoma) was a bit worse at 40%. But the loss was smaller for Midwest-Southwest (i.e. Los Angeles/Long Beach/Oakland), down 27%.

The chart compares the three-month moving average intact container volume for each lane with its prior performance in 2019. Each lane’s average monthly volume in 2019 is set at an index level of 100. The data shows that Midwest-Western Canada was a clear out-performer during the early stage of the pandemic-induced surge. But the situation turned in late 2020 and the lane’s performance came back down to Earth. The loss has been particularly acute since the end of Q1 2022. This is exactly the period when one might have expected the lane to benefit from volume diverting away from potential labor-related disruptions at the US West Coast gateways to the south.

The outlook in the near term could be particularly grim. Even as the USWC standoff appears to be making real progress towards a resolution, the ILWU Canada contract has now expired. Government-mandated mediation and cooling-off periods will enforce the status quo in Western Canada through at least June, but it is possible that strike actions or lockouts could occur thereafter. If the US West Coast situation is resolved, then we could see the fear of labor disruptions fueling diversion away from Western Canada, making what appears to be a bad situation even worse.

Source: Journal Of Commerce