The broad US economic outlook is improving as inflation slowly drops, but trucking companies and others involved in moving freight have a rough road ahead of them in the first half of 2023, speakers said Monday at the SMC3 JumpStart 2023 conference in Atlanta.

“The most likely scenario for the macroeconomy is a mild and short recession, but the freight economy [outlook] is worse,” Bob Costello, chief economist for the American Trucking Associations, said during a panel discussion on the outlook for 2023.

Consumers are spending more on services than goods, US manufacturing has slowed, residential housing construction is in recession, and big-box retailers have overstocked inventories. “You add all that up, and you have a freight recession,” Costello said.

That means lower volumes for carriers, and lower rates for shippers, but it doesn’t mean a freight market collapse. Brent Hutto, chief relationship officer of Truckstop.com, pointed out that spot pricing remains more than 20 percent above the pre-pandemic five-year average.

“This feels like a recession because market activity was so high [in 2021 and 2022],” Hutto said, adding spot rates have been fluctuating in a narrow range for several months. He didn’t expect much further decline.

Freight volumes are beginning to hit difficult year-over-year comparisons. The Cass Freight Shipments Index dropped 3.9 percent year over year in December, following a 0.4 percent decline in November. The Cass shipments index was up 3.5 percent on a two-year stacked basis.

The measure of freight volume has declined sequentially for five consecutive months.

Costello and other speakers expect the “freight recession” will not be a long one. “We’ve got this quarter and next quarter before we get through it,” said Costello. “We’ll hit bottom and flatten out before we come up.”

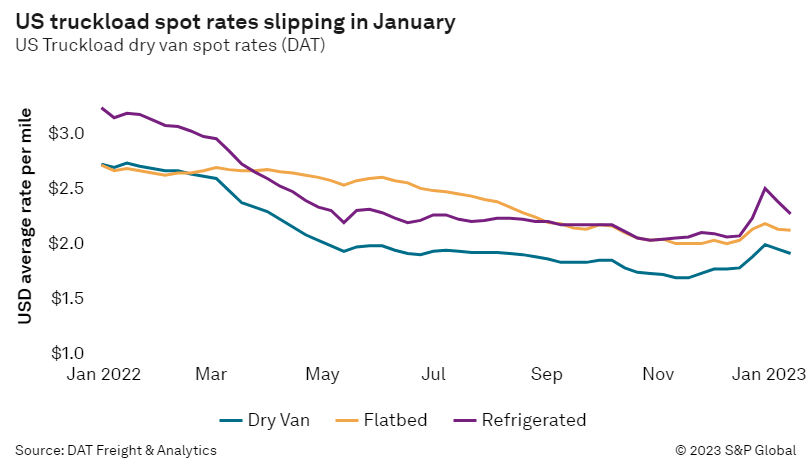

That echoes projections from analysts at digital broker Loadsmart, Coyote Logistics, DAT Freight & Analytics, and others that spot truckload pricing is nearing its floor. DAT spot rates rose month to month in December for the first time in 2022, bouncing off low prices in November.

“Our expectation is that spot pricing plateaus for a while and goes back up,” Costello said.

The national average for shipper-paid, all-inclusive US spot rates rose $0.04 per mile from November through mid-January, climbing to $2.59 per mile, according to a Journal of Commerce analysis of data from Cargo Chief, DAT Freight & Analytics, Loadsmart, and shipper and broker surveys.

Contract truckload rates will continue to fall, but it’s not clear for how long, according to the panel. Hutto suggested contract truckload pricing may not find its bottom until late in the year.

Cautious optimism returns

A broader macroeconomic analysis offers some support for cautious economic optimism. Globally, interest rates are nearing their peaks, and cooling demand and “supply chain resilience” are leading to disinflation, according to S&P Global Market Intelligence.

The Material Price Index by S&P Global has fallen 30 percent from its March 2022 peak and is 10 percent lower year over year in mid-January, S&P said in a report Friday. Consumers should see more price relief in the second half, S&P Global said.

S&P Global, the parent company of the Journal of Commerce, continues to forecast a mild US recession in the first half of 2023, led by an inventory drawdown and declines in residential housing, commercial construction, and consumer goods spending.

“I think it would be ignorant to think we’re not going to have some recessionary activity in our economy because it’s probably needed,” said Hutto.

Inventories are a headwind for freight, Costello said, but not all inventories. “When you peel the numbers back, it’s the big-box retailers that have too much inventory,” he said.

US manufacturers still need inventory, said Jason Bergman, the chief commercial officer of less-than-truckload (LTL) carrier Yellow. “Aerospace, automotive, and defense manufacturers are chronically under their normal inventory levels, and as soon as raw materials become available, they’ll be buying inventory like you wouldn’t believe,” Bergman said. “They’re sitting on orders right now.”

US industrial production dropped 0.7 percent month to month in December, while manufacturing output fell 1.3 percent, according to the US Federal Reserve System. Manufacturing output dropped 0.5 percent year over year.

LTL carriers traditionally have a more industrial freight mix than their large truckload counterparts, and Bergman believes LTL freight will rebound later in the year. In addition, “we’ll see the non-residential construction piece of the market get stronger in the second half,” he said.

Unlike in 2019, the current “recession” in industrial freight isn’t from a lack of demand, according to Bergman.

“This time manufacturers have been set back because of their inability to get raw material,” he said.

Source: Journal Of Commerce