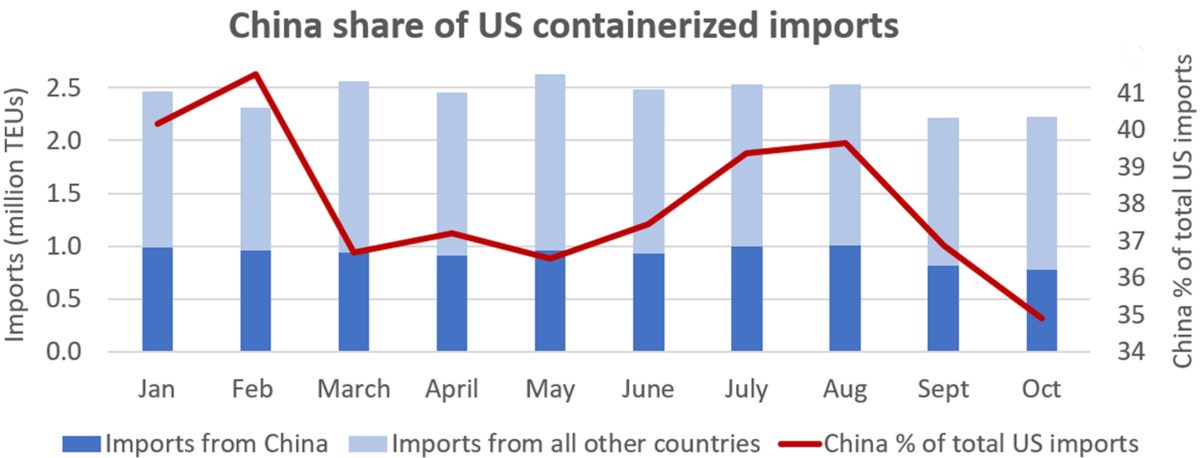

America and China remain intimately intertwined via trade despite worsening tensions over Taiwan and the Russia-Ukraine war. More than a third of all U.S. containerized imports arrive from China. More than a sixth of China’s export value derives from U.S. purchases.

But there are growing signs of at least some decoupling. In recent months, America’s imports from China have fallen faster than total imports. Other Asian countries are increasingly taking U.S. market share from China, a trend that began before the pandemic and has continued.

Imports from China falling faster than total imports

According to new data from Descartes, U.S. containerized imports in October were flat (up 0.2%) versus September. But imports from China fell 5.5% month on month, by 45,071 twenty-foot equivalent units. The decline from China was entirely offset by gains from Thailand, South Korea, Taiwan, Japan, and other countries.

In September, Descartes data showed a 12% plunge in total U.S. imports versus August. Imports from China fell faster: by 18% or 83,396 TEUs.

Chinese volumes accounted for 40% of all U.S. imports in August and an even higher share — 42% — in February. Last month, its share of U.S. imports was down to 35%.

(Chart: American Shipper based on data from Descartes Datamyne)

Chris Jones, executive vice president of industry and services at Descartes, told American Shipper: “You can see that during the highly publicized lockdowns [earlier in the year], there was still a healthy flow of goods out of China.

“However, there were also highly publicized comments by major retailers and others saying that they were reducing their international purchases — largely out of China — and looking for alternate sources. And that is happening now.”

Bookings in China are falling faster than total bookings

Data from FreightWaves SONAR shows that bookings for China-to-U.S. cargoes have slowed more than overall inbound bookings.

Throughout 2021, the index for bookings loaded in China was significantly higher than for all export destinations. The gap has narrowed since March and has now almost vanished, as the China-to-U.S. bookings index declined faster than the overall index.

Source: Freight Waves