Ocean carriers are struggling to secure volume commitments from US importers on the eastbound trans-Pacific as continued softening of spot rates tempts shippers, particularly smaller ones, to not honor their contracts.

With most new trans-Pacific service contracts in effect only since late May, container lines are already nudging shippers to meet their minimum quantity commitments (MQCs) rather than take advantage of spot rates that have been cratering for approximately three weeks, sources tell the Journal of Commerce.

While larger retailers this summer are shipping under their contract rates that are $200 to $300 per FEU higher than current spot rates, small and mid-size importers are shipping under the low spot rates while they can, knowing that carriers will levy peak season surcharges this fall. The Journal of Commerce spoke to six forwarders and two carrier executives for this story.

“They [mid-size shippers] do have a transactional mindset,” one carrier executive said. “They will pay the peak season surcharge.”

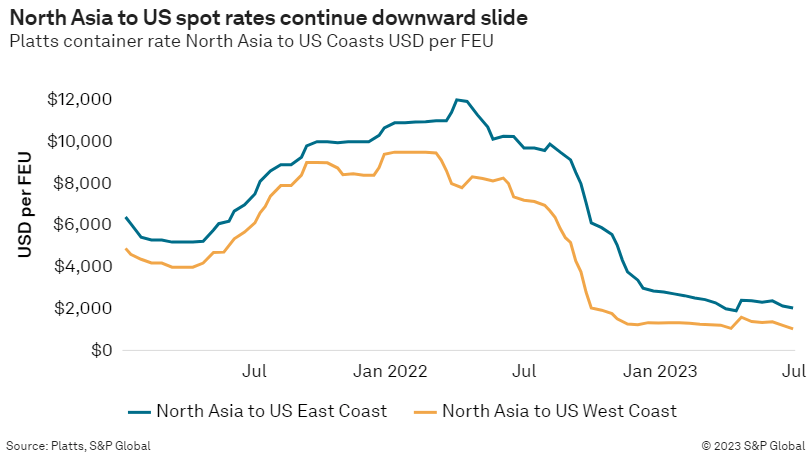

Small and mid-size shippers this spring signed 2023-24 service contracts with rates in the range of $1,350 to $1,500 per FEU to the West Coast and $2,350 to $2,500 per FEU to the East Coast. The spot rate from Asia to the West Coast last week slipped $50 to $1,200 per FEU, while the East Coast rate dropped $150 to $2,100 per FEU, according to the Platts container freight index. Platts and the Journal of Commerce are owned by S&P Global.

A mid-sized shipper said the $200 to $300 difference between the spot and contract rate was “hard to ignore.” He expected some importers would ship under the lower spot rate rather than honor volume commitments in their more costly service contracts even though it could contribute to breaking down the trust that carriers and their steady customers are attempting to rebuild after two tumultuous years of historically high spot rates that exceeded $10,000 per FEU to the West Coast and $12,000 per FEU to the East Coast.

“There certainly are some shippers who will do that while there is so little cargo out there,” a second carrier executive told the Journal of Commerce.

The source added, however, that most carriers will not apply bookings made under the spot rate toward fulfilling the customers’ MQCs. That means importers who do not fill their minimum volume commitments by the end of the contract could be charged for the shortfall.

Furthermore, even though spot rates are falling now, shippers should not expect that the rates will continue to decline indefinitely because most carriers will turn down shipments that lose them money.

“When the rates reach a certain level, the carriers will just say no,” the second carrier executive said.

Import volumes ticking higher

Most retailers, especially larger ones, ship at least 70% of their annual import volumes under contract rates, said Kurt McElroy, executive vice president of the forwarder KerryApex. They book the remaining volumes under spot rates, either with non-vessel-operating common carriers (NVOs) or directly with the carriers.

In a recent survey of shippers, management consulting firm AlixPartners said respondents indicated they intend to ship 80% of their volume for the year under contract in order to be in a position to ship under spot rates if trans-Pacific volumes remain soft.

“This strategy is what we commonly see within the marketplace due to the uncertainty of shipper volume forecasts, but it poses a gamble and may either pay off if rates dip or cost more in the long run if rates increase,” AlixPartners said.

Import volumes have ticked higher in each month of the past three months; that trend is expected to continue into the peak season. “We should see these volumes increase, though certainly at reduced levels compared to last year,” McElroy said.

Carrier and NVO sources say that because a tentative West Coast labor contract was reached in mid-June, retailers that had shifted a sizeable amount of discretionary cargo to East and Gulf coast ports over the past year will gradually move some of that cargo back to the West Coast beginning in mid- to late July.

“You can’t avoid the West Coast forever,” one of the carrier executives said. “It’s a natural gateway for certain types of products.”

Higher-value merchandise that is time-sensitive naturally moves through the West Coast, while lower-value products that can tolerate an extra week or two of transit time tend to move via all-water services from Asia to the East Coast, he said.

Source: Journal Of Commerce