A regulatory framework is urgently needed to support scaled-up production of renewable fuels for shipping to reduce the price premium with fossil fuels, according to green energy producer Ørsted.

Olivia Breese, CEO of Ørsted Power-to-X, a division of the group involved in conversion technologies that turn electricity into carbon-neutral synthetic fuels such as e-methanol, said in a statement Tuesday that in the absence of regulatory action, the company was prepared to assume risk in its development of green fuels.

“However, the Power-to-X industry urgently needs supportive frameworks that enable the transition away from fossil fuels, and we call on policymakers to take action to match the climate ambitions of developers and shipping companies,” she said.

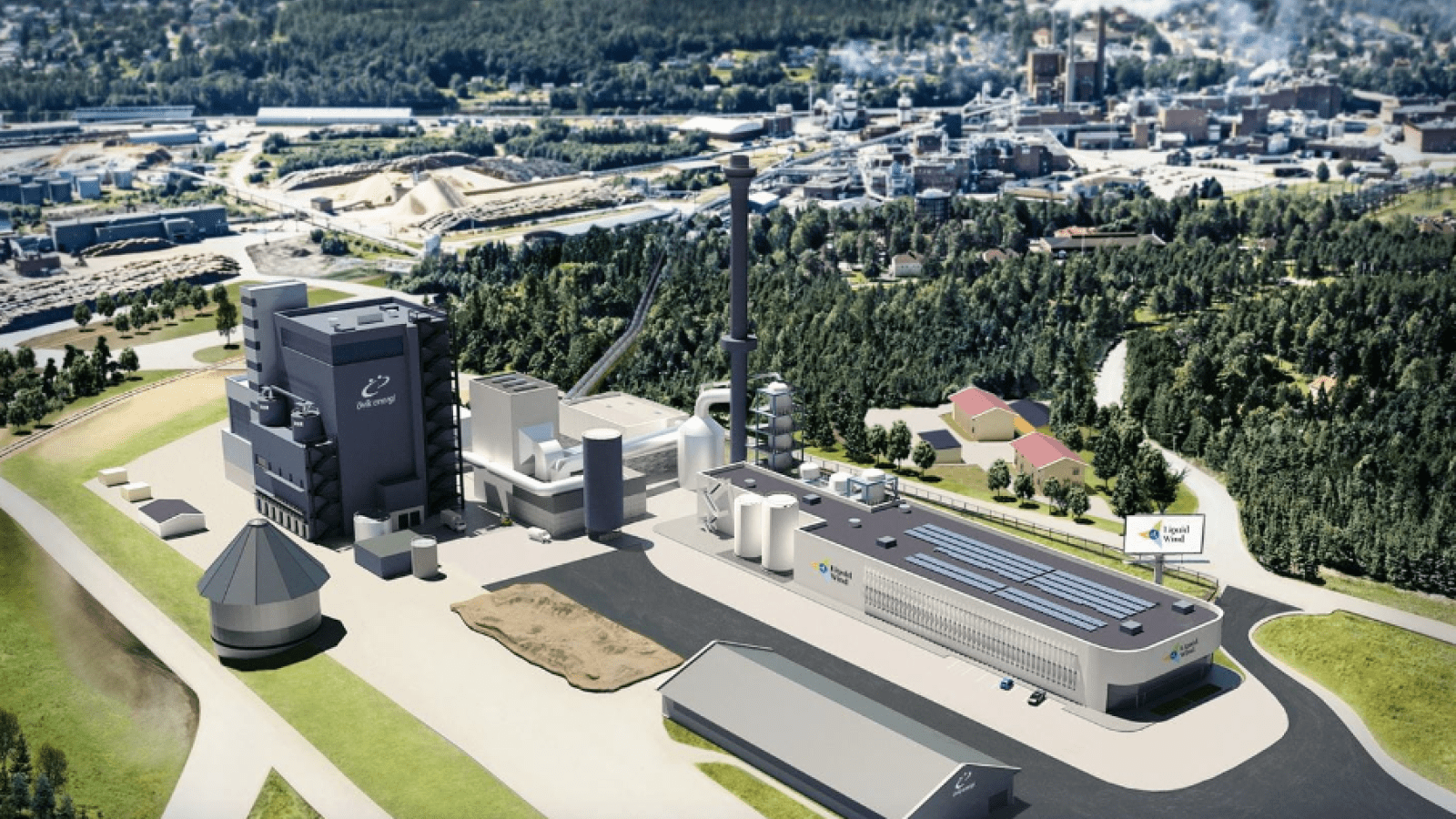

The Danish power company this week took over full ownership of FlagshipONE, Europe’s largest e-methanol plant, which will begin producing 50,000 tonnes of the renewable fuel a year from 2025 that will go towards decarbonizing the shipping industry.

Ørsted acquired the remaining 55 percent stake of the project in northern Sweden for an undisclosed sum from Liquid Wind, the original developer. The company is also developing the 300,000-tonne Project Star along the US Gulf Coast and the Green Fuels for Denmark project in Copenhagen, which will both produce significant volumes of e-methanol for shipping.

The scale required to meet shipping’s demands is staggering. The shipping industry uses more than 300 million tons of fossil fuels every year, about 5 percent of global oil production that accounts for 3 percent of carbon emissions caused by human activities.

To put the world on track for net-zero emissions by 2050, the International Energy Agency (IEA) has estimated that clean energy investment of at least $4 trillion by 2030 will be required, three times what is being invested today. Some industry estimates put the cost of decarbonizing shipping at more than $1 trillion, a price that will require both public and private investment with a solid regulatory framework.

Earlier this year, the World Shipping Council (WSC) called a regulatory structure underpinning the development and production of zero-carbon fuels “a crucial missing part” in the global campaign to decarbonize the maritime industry.

‘Substantial uncertainties’ in pricing

Mads Nipper, group president and CEO of Ørsted, said in the statement that e-methanol was the best solution currently available to decarbonize hard-to-electrify sectors like global shipping.

“Now more than ever, the world needs bold green energy projects to fight climate change, decarbonize hard-to-electrify sectors, and secure regional energy independence,” he said.

But the Ørsted statement noted that pricing of e-methanol for its consumers would be subject to “substantial uncertainties” until incentivizing regulatory action matched the ambitions of developers and carriers.

Earlier this year, Maersk estimated that if left unsubsidized, synthetic fuels such as e-methanol would be twice as expensive as current fossil fuels. The carrier, and the rest of the container shipping industry, is in favor of carbon pricing instruments to raise the revenue required to invest in decarbonization, a cost that would be passed on.

However, Olaf Merk, who leads ports and shipping research at the International Transport Forum (ITF), an intergovernmental organization within the Organization for Economic Co-operation and Development (OECD), cautioned that carbon pricing should not become simply another surcharge to be passed on to customers without real change in the behavior of shipping companies.

“That is why choosing the right design of the scheme is important,” Merk told the Journal of Commerce last week. “We would favor a ‘feebate’ system in which the price gap between conventional fuels and zero-emission fuels is fully bridged to stimulate the uptake of zero-emission fuels and energy sources.”

Several major carriers are investing in the search for a fuel of the future that can power the container shipping industry. While CMA CGM and French energy giant Engie are co-investing in a biomethane project in the North European hub port of Le Havre, Maersk is developing an e-methanol pathway to secure fuel for its fleet of 19 methanol-compatible container ships on order and due for delivery over the next three years.

Maersk in November signed a strategic partnership with US-based project developer Carbon Sink that will provide 100,000 tonnes of e-methanol a year from its South Dakota plant from 2027. In August, Maersk partnered with Chinese bioenergy supplier Debo. And in March, the carrier announced partnerships with CIMC ENRIC, European Energy, Green Technology Bank, Ørsted, Proman, and WasteFuel with the intent of sourcing at least 730,000 tons per year by the end of 2025.

Source: Journal Of Commerce