Blog

Read recent news, updates and articles about our company.

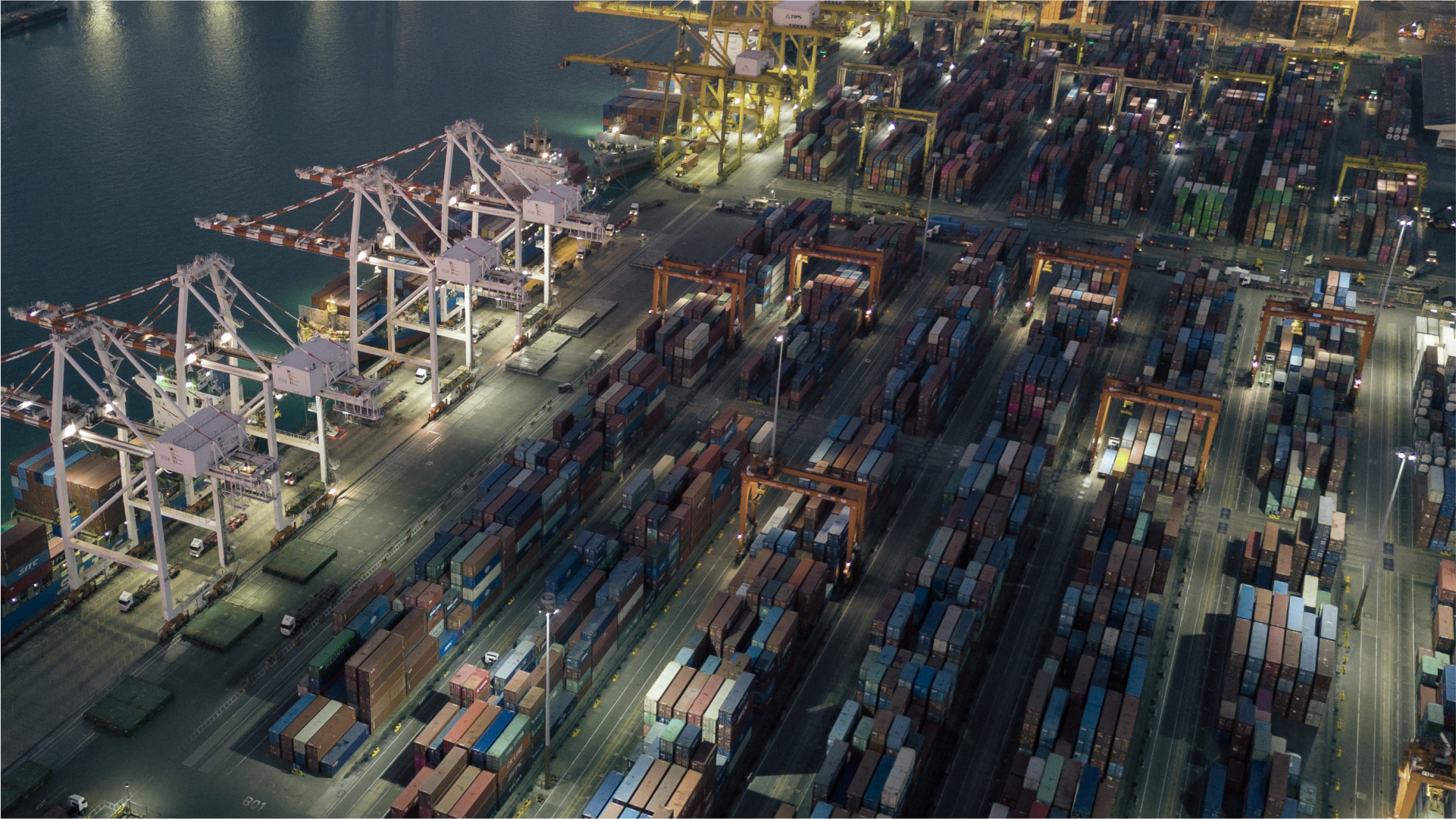

Logistics

Let’s get started →

Grow your brand with extended warehouse network and simplified logistics

Transportation

300+ Happy Customers

Flexible warehouse and office space

Choose how you ship

Grow nationally across multiple locations

RESOURCES

Useful Links

Read recent news, updates and articles about our company.